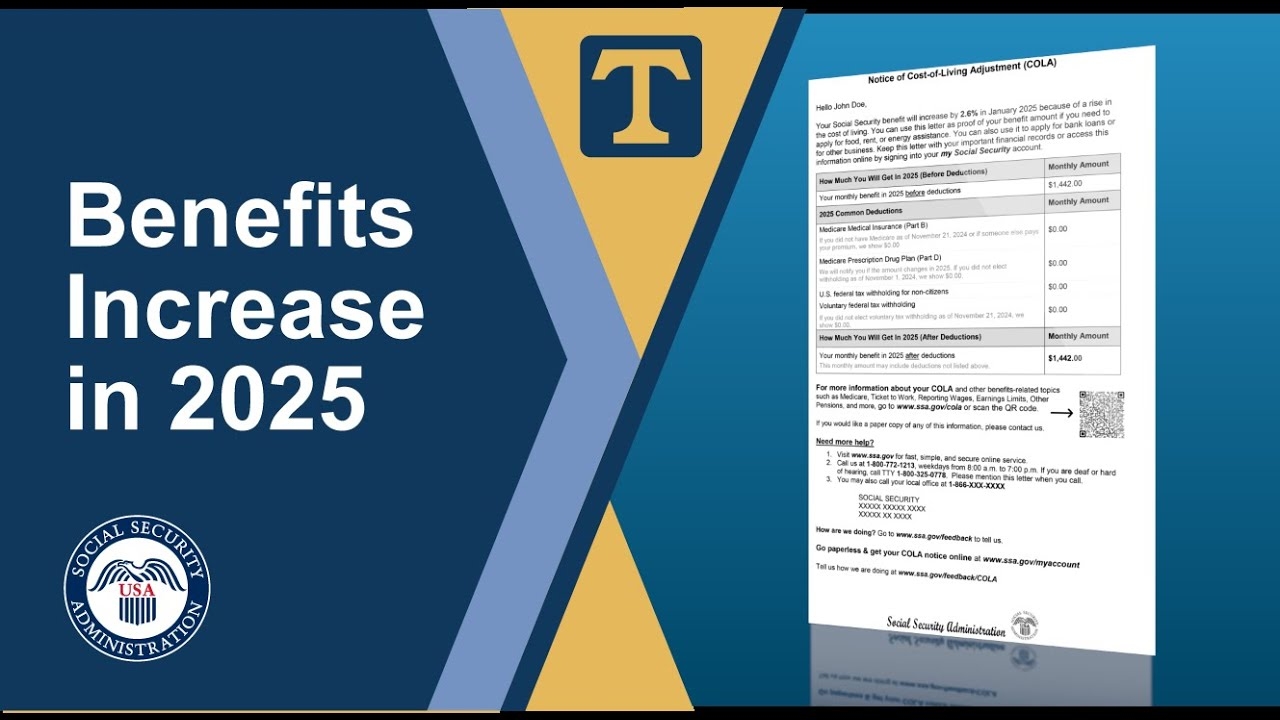

The Social Security Administration (SSA) has announced a significant change for millions of Americans receiving Social Security benefits. Starting in 2025, beneficiaries will see a 2.5% increase in their monthly payments due to the annual Cost-of-Living Adjustment (COLA). This adjustment aims to help recipients keep up with rising living costs and maintain their purchasing power in the face of inflation.

The 2025 COLA, while lower than in recent years, still represents a meaningful boost for the more than 72.5 million Americans who rely on Social Security and Supplemental Security Income (SSI) benefits. This increase will affect various types of Social Security payments, including retirement, disability, and survivor benefits. For many retirees and disabled individuals, this adjustment could mean the difference between making ends meet and facing financial hardship.

Understanding the Social Security Benefits Increase

The Social Security benefits increase for 2025 is part of the program’s ongoing effort to ensure that beneficiaries can maintain their standard of living as prices for goods and services rise over time. This adjustment is calculated based on changes in the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), which measures inflation.

Overview of the 2025 Social Security Benefits Increase

| Feature | Details |

| Increase Percentage | 2.5% |

| Effective Date | January 1, 2025 |

| Average Retirement Benefit Increase | $49 per month |

| New Average Retirement Benefit | $1,976 per month |

| Maximum SSI Payment (Individual) | $967 per month |

| Maximum SSI Payment (Couple) | $1,450 per month |

| Social Security Wage Base | $176,100 |

| Beneficiaries Affected | Over 72.5 million Americans |

| COLA Calculation Method | Based on CPI-W |

Key Changes for Beneficiaries

The 2025 Social Security benefits increase will bring several important changes for recipients:

- Higher Monthly Payments: Most beneficiaries will see their monthly checks grow by 2.5%.

- Increased Maximum Benefits: The maximum Social Security benefit for workers retiring at full retirement age will rise.

- SSI Payment Boost: Supplemental Security Income recipients will also benefit from the 2.5% increase.

- Adjusted Earnings Limit: The amount beneficiaries can earn without affecting their benefits will increase.

Impact on Different Types of Benefits

The 2025 COLA will affect various Social Security programs differently. Let’s explore how each type of benefit will change:

Retirement Benefits

Retirees will see their monthly payments increase by 2.5%. For the average retiree receiving $1,927 per month in 2024, this translates to an additional $49 per month, bringing their total to $1,976 in 2025. This extra income can help cover rising costs for essentials like food, housing, and healthcare.

Disability Benefits

Social Security Disability Insurance (SSDI) recipients will also receive the 2.5% COLA. This increase can be particularly important for disabled individuals who may face higher medical expenses and limited ability to supplement their income through work.

Supplemental Security Income (SSI)

SSI beneficiaries, who are often among the most financially vulnerable, will see their maximum monthly payments increase. For individuals, the maximum SSI payment will rise to $967 per month, while couples can receive up to $1,450 per month.

Changes to Social Security Taxes and Earnings Limits

Along with benefit increases, there are changes to Social Security taxes and earnings limits that workers and beneficiaries should be aware of:

Social Security Wage Base Increase

The maximum amount of earnings subject to Social Security tax, known as the wage base, will increase from $168,600 in 2024 to $176,100 in 2025. This means high-income earners will pay Social Security taxes on a larger portion of their earnings.

Earnings Test Limits

For beneficiaries who are still working while receiving Social Security, the earnings limits will change:

- For those under full retirement age: The limit will increase to $23,400 per year.

- For those reaching full retirement age: The limit will rise to $62,160 per year.

Earnings above these limits may result in a reduction of benefits, but only until the beneficiary reaches full retirement age.

How to Prepare for the 2025 Benefits Increase

To make the most of the 2025 Social Security benefits increase, recipients should consider the following steps:

- Review Your Budget: Adjust your budget to account for the additional income and rising costs.

- Check Your Benefit Statement: Ensure that your earnings record is accurate, as this affects your benefit amount.

- Consider Your Claiming Strategy: If you haven’t yet claimed benefits, think about how the increase might affect your decision on when to start receiving payments.

- Stay Informed: Keep up with any announcements from the SSA regarding changes to benefits or programs.

Long-Term Outlook for Social Security

While the 2025 COLA provides some relief for beneficiaries, it’s important to consider the long-term outlook for Social Security:

- Future COLAs: COLAs may vary significantly from year to year based on inflation rates.

- Program Solvency: Discussions about ensuring the long-term financial stability of Social Security continue among policymakers.

- Potential Changes: Future reforms may affect benefit calculations, retirement ages, or funding mechanisms.

Importance of Additional Retirement Savings

Despite the Social Security benefits increase, it’s crucial for individuals to have additional retirement savings:

- Supplement Social Security: Benefits alone may not be sufficient to maintain your desired lifestyle in retirement.

- Prepare for Uncertainties: Additional savings can help cover unexpected expenses or changes in the Social Security program.

- Take Advantage of Employer Plans: Maximize contributions to 401(k)s or similar retirement accounts if available.

Conclusion

The 2025 Social Security benefits increase of 2.5% represents a modest but important adjustment for millions of Americans. While this COLA helps beneficiaries keep pace with rising costs, it’s essential to view it as part of a broader financial strategy. Recipients should stay informed about changes to the program, manage their benefits wisely, and consider additional savings to ensure financial security in retirement.

By understanding the details of the 2025 increase and planning accordingly, beneficiaries can make the most of their Social Security payments and work towards a more stable financial future.

Disclaimer: The information provided in this article is based on current announcements and projections from the Social Security Administration. Actual benefit amounts and program details may vary. Recipients should consult official SSA sources or financial advisors for personalized information regarding their benefits.